Studying at Moore College can be costly, so students need to carefully consider expenses and plan how they will fund their education before applying. This is especially important for international students, whether single or with a family.

General information

Things to be aware of:

- The Student Support Fund has been established to help students raise funds while they’re at College.

- Scholarships are available; however, they are competitive and will not cover all your expenses.

- Full-time study at Moore College is demanding and students should not assume they will be able to perform paid work during study periods (other than a paid church ministry role). International students should check the conditions on their visa regarding work while in Australia.

- If you are travelling with a spouse and/or family, they will also need visas and proof that they can support themselves, or be supported financially.

- Australia is a country with a high standard of living and hence relatively high expenses for accommodation, food, travel, education, medical and incidental expenses.

Starting from 10 May 2024, international student visa applicants are required to demonstrate a minimum savings of AU$29,710 to cover their annual living expenses. Additional funds will be necessary for those with accompanying family members. For more information, please refer to Department of Home Affairs website.

The Cost of Living Calculator is designed to help you estimate the expenses associated with maintaining your desired lifestyle in Australia.

Overseas Student Health Cover (OSHC) must be covered for the entire stay in Australia from the date of arrival, from an approved Australian health insurance provider. Single OSHC costs around $3,300 for a four-year program.

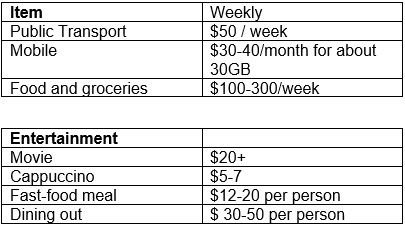

To help you plan your budget before starting at Moore College, here is a budget planner to assist you in your planning. The average living costs for students are roughly between AU$1,400 and AU$2,500 every month.

If you’re an international student with school-age children, you would need to consider additional costs (e.g. primary school-age children need to pay fees of about $15,000 per year, per child).

Other helpful links

The following are some helpful websites that might assist you:

- A helpful summary of Australian Government Support that’s available for students.

- The following budget planner can be used to estimate your income and expenses.

- Some of this information from Sydney University could be of assistance to you in managing your budget whilst at College.

- Please also review the following website for visa conditions if you are planning to work whilst studying in order to generate income.

- Students with a Centrelink Health Care Card can apply for Saver Plus. This provides $500 towards educational costs such as laptops, tablets and textbooks in a matched savings program.

If you’d like more information, please contact the Moore College Partnerships at +61 (0)2 9577 9900 or [email protected].